The most crucial SDIRA rules from your IRS that traders require to comprehend are investment restrictions, disqualified folks, and prohibited transactions. Account holders should abide by SDIRA guidelines and regulations so that you can maintain the tax-advantaged standing of their account.

Have the liberty to speculate in Practically any sort of asset which has a danger profile that matches your investment method; including assets that have the likely for the next charge of return.

Choice of Investment Possibilities: Ensure the company permits the kinds of alternative investments you’re enthusiastic about, like real estate property, precious metals, or private equity.

Before opening an SDIRA, it’s crucial to weigh the possible positives and negatives based upon your distinct economic objectives and danger tolerance.

Larger investment solutions indicates you'll be able to diversify your portfolio over and above stocks, bonds, and mutual funds and hedge your portfolio versus sector fluctuations and volatility.

Put simply, when you’re searching for a tax effective way to construct a portfolio that’s extra customized for your passions and experience, an SDIRA could be the answer.

SDIRAs tend to be used by arms-on investors who're ready to take on the pitfalls and responsibilities of selecting and vetting their investments. Self directed IRA accounts can be great for traders who have specialised knowledge in a distinct segment market which they would want to spend money on.

Be in command of the way you expand your retirement portfolio by utilizing your specialised understanding and passions to take a position in assets that in good shape along with your values. Obtained know-how in real estate or private fairness? Use it to aid your retirement planning.

An SDIRA custodian is different since they have the appropriate team, knowledge, and capability to take care of custody on the alternative investments. The initial step in opening a self-directed IRA is to find a company that's specialized in administering accounts for alternative investments.

Assume your friend could be starting up the subsequent Facebook or Uber? With the SDIRA, you could spend money on results in that you suspect in; and likely love bigger returns.

Certainly, real estate property is one of our clientele’ most popular investments, sometimes termed a real estate property IRA. Consumers have the option to speculate in every little thing from rental Qualities, professional real-estate, undeveloped land, home loan notes plus much more.

As an Trader, on the other hand, your choices usually are not restricted to shares and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can change your portfolio.

Greater Fees: SDIRAs normally feature larger administrative expenses when compared with other IRAs, as sure areas of the administrative process can't be automated.

This incorporates comprehension IRS polices, managing investments, and keeping away from prohibited transactions which could disqualify your IRA. A scarcity of knowledge could lead to high-priced problems.

If you’re seeking a ‘set and neglect’ investing strategy, an SDIRA likely isn’t the appropriate selection. As you are in whole control about each and every investment built, It really is your choice to carry out your own homework. Bear in mind, SDIRA custodians are usually not fiduciaries and cannot make recommendations about investments.

The tax strengths are what make SDIRAs interesting for many. An SDIRA may be the two standard or Roth - the account variety you select will depend largely on the investment and tax system. Look at with all your economical advisor or tax advisor for those who’re Not sure which can be ideal for yourself.

Constrained Liquidity: Lots of the alternative assets that can be held within an SDIRA, for instance real estate, private equity, or precious metals, will not be easily liquidated. This may be an issue if you must obtain resources promptly.

Making one of the most of tax-advantaged accounts lets you maintain more of The cash which you invest and gain. Dependant upon regardless of whether you choose a conventional self-directed IRA or perhaps a self-directed Roth IRA, you have got the prospective for tax-free or tax-deferred growth, delivered particular ailments are achieved.

A self-directed IRA is undoubtedly an extremely highly effective investment car, but it really’s not for everybody. As the stating goes: with wonderful electricity arrives terrific responsibility; and having an SDIRA, that couldn’t be extra true. Keep reading to find out Continue why an SDIRA might, or may not, be for yourself.

Opening an SDIRA can provide you with access to investments Commonly unavailable by way of a lender or brokerage agency. Here’s how to begin:

Jaleel White Then & Now!

Jaleel White Then & Now! James Van Der Beek Then & Now!

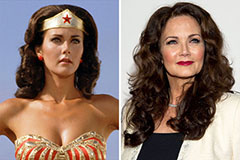

James Van Der Beek Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Batista Then & Now!

Batista Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!